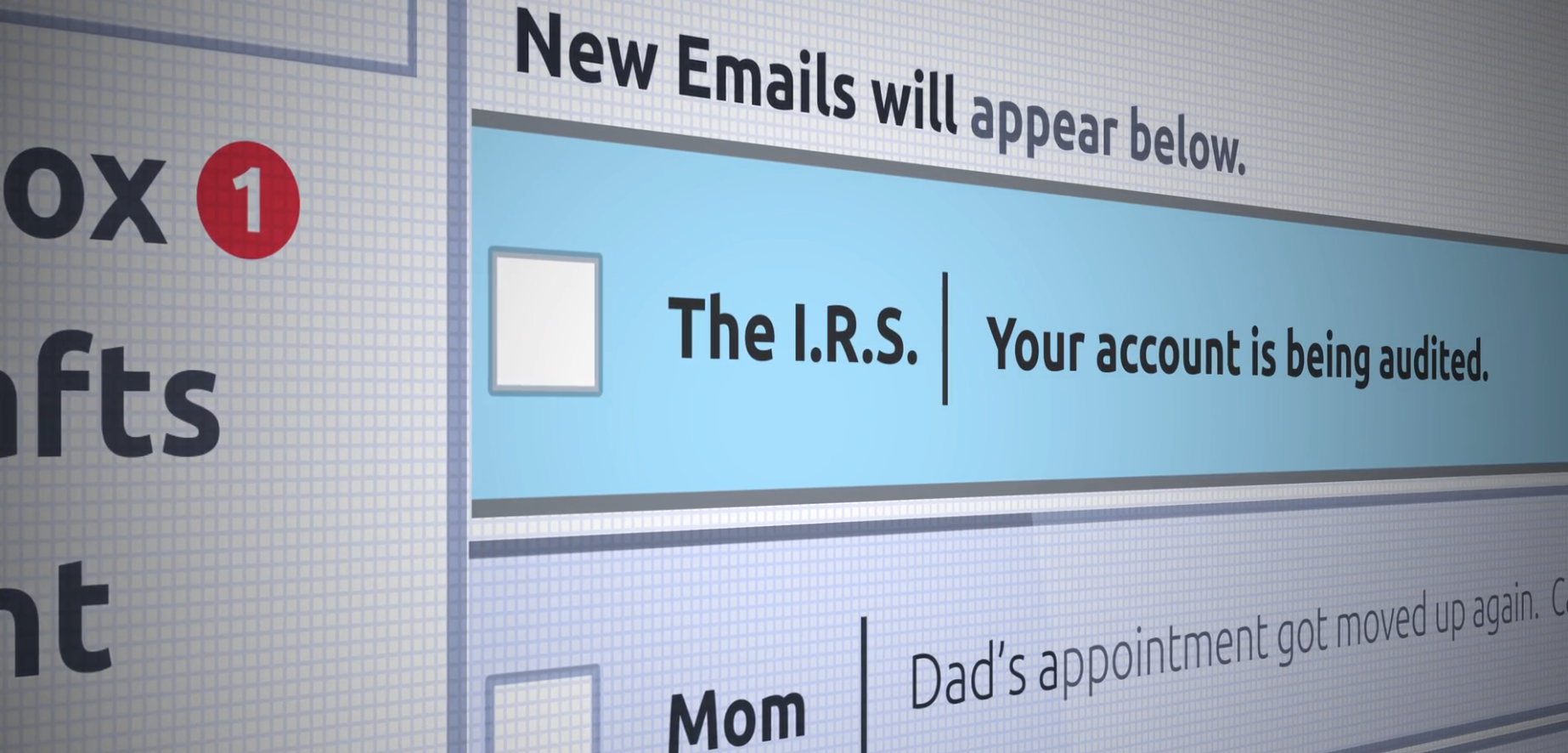

IRS Releases 2025 Dirty Dozen Tax Scams

Watch Out for These 2025 Tax Scams: The IRS Dirty Dozen

The IRS has released its 2025 Dirty Dozen list—an annual warning about the most common and dangerous tax scams targeting individuals and businesses.

At MH, we believe that awareness is your first line of defense. That’s why we’re sharing this year’s overview to help you spot the red flags and protect yourself from fraud.

This year’s list includes phishing emails, fake charities, misleading social media advice, overstated withholding schemes, and bogus tax credit claims. These scams aren’t just limited to tax season—fraudsters operate year-round, looking to steal your money, personal data, or file fraudulent returns in your name.

The IRS urges taxpayers to stay vigilant and report anyone promoting abusive tax schemes or knowingly preparing improper returns.

Click HERE for the overview of the 2025 Dirty Dozen List.

🔗 Read the full Dirty Dozen list from the IRS here: https://www.irs.gov/newsroom/dirty-dozen-tax-scams-for-2025-irs-warns-taxpayers-to-watch-out-for-dangerous-threats